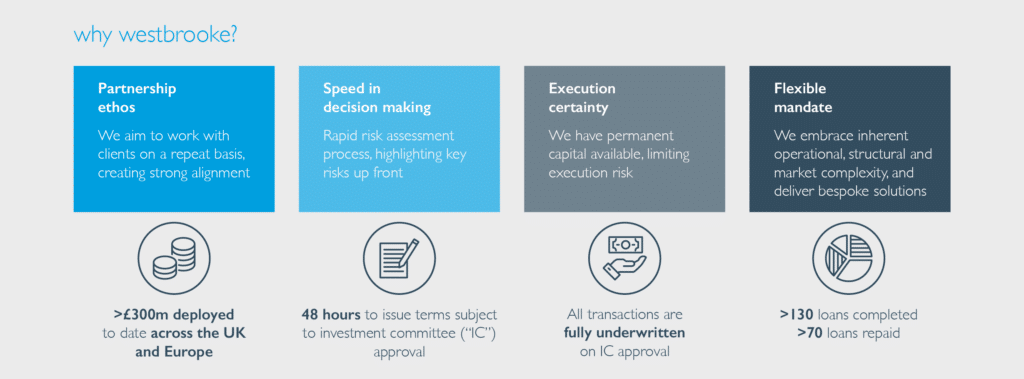

Westbrooke Dynamic Opportunities provides bespoke financing solutions to a range of privately owned, lower mid-market UK companies. Investing across the entire capital structure, Westbrooke Dynamic Opportunities offers a combination of senior debt, intermediate capital and minority equity financing.

The investment strategy capitalises on opportunities that deliver investors with a combination of debt-like risk mitigants, but with potential for equity return characteristics.

Westbrooke’s hybrid capital investments are concluded on a deal-by-deal basis across the capital structure, with a combination of higher- yielding secured debt, subordinated and PIK debt, and structured equity investments. The strategy typically provides investors with an annual cash yield, as well as an equity upside / profit participation component.

key investment highlights

Attractive returns: target net IRRs of 10% – 20% per annum in GBP (typically through a combination of a contractual coupon and variable equity upside)

Contractual liquidity: investments benefit from contractual repayment terms providing investors with liquidity

Risk controlled: investments benefit from security and significant equity cushions

Tenor: typical investment term is 2 – 5+ years

Market dislocation: limited appetite from traditional lenders to provide flexible funding to the UK lower-middle market segment

Track record: team with experience investing across the capital structure within diverse industries